By Rod Williams, April 21, 2022- I spent my career as a housing counselor serving as Director of Housing Services for the Woodbine Community Organization and had the pleasure of helping hundreds of low to modest income people become homeowners. It was rewarding work.

The majority of those we helped were not in need of much help. They were only low-income because they were young and starting their careers. They may have needed some advice on repairing their credit or building credit, they needed some education on mortgage programs and the home buying process, and some help with the downpayment. Tennessee, like all states, has a program to help first-time homebuyers with downpayment assistance or with programs that reduce mortgage interest rates. One can learn about these programs at this link.

In addition to helping the first-time homeowner who only needed a little help, the agency I worked for helped hundreds of hardcore low-income people become homeowners. Not all low-income people have the same challenges. There are low-income people with middle-class values who are only low-income because they are young or working jobs that don't pay much. Then, there are those trapped in the cycle of poverty and the welfare system who have circumstances and values that make homeownership hard to achieve.

To help these people was challenging and took a minimum of a solid year of monthly classes and numerous one-on-one counseling sessions. For some, it took years before they were ready to buy a house. Almost all of these people would become the first in their families to ever own a home. Many came out of public housing. For these people, it required that they change their values and habits. They had to change their way of thinking. Most of the people who joined what we called "homebuyers clubs," could not or would not make the changes necessary to become homeowners, but many did. It was rewarding when you could see the light go off and habits start to change.

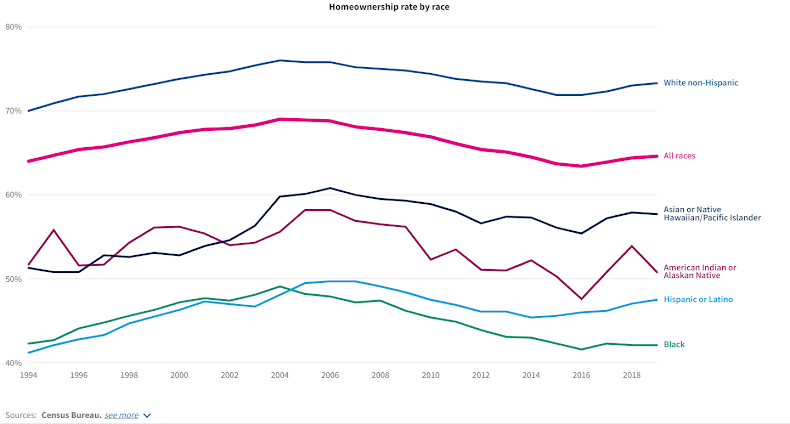

There were various grants and mechanisms to help the hardcore poor but in the end, the client had to have an acceptable credit score, reportable income sufficient to finance the majority of the sale price of the home, and some savings. When these people got into a house, they were ready for homeownership. Sadly, hardcore low-income people will never be able to buy a home the way things are today. When I was a housing counselor, I could encourage the single mother on welfare living in public housing, that if she was willing to make hard changes and put in the effort, homeownership was possible. Today, I could not hold out that hope. The dream of homeownership would have to remain a dream. Most of the people I served in this category of the hardcore generation poor were African Americans. Unfortunately, the rate of homeownership among African Americans is lower now than in 1994. All of the talk about "equity," and social justice, and the building of resentment does nothing to lift people out of poverty. All of the pious talk about "affordable housing," will put very few poor people into a home.

Unfortunately, not only for the generationally hardcore poor, is homeownership likely to remain a dream, but it is more and more likely to remain a dream for many middle-class people also. Recently my daughter and her husband became homeowners. I was able to help them. For many people without parents who are able to substantially help them, they will never be able to realize the dream of homeownership. That is a sad fact of life.

Home prices and interest rates continue to skyrocket with no end in sight putting homeownership out of the reach of many working people.

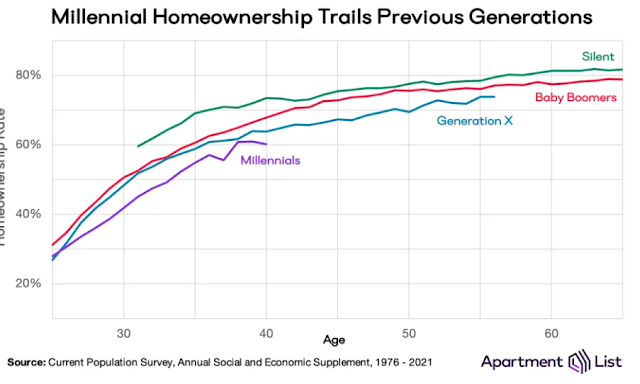

An organization called Apartment List which does research on housing issues and tracks trends in home and rental prices recently conducted a survey of people and found that many Millennials told them they are quickly coming to the conclusion that they may never be able to afford a home, and most who do want to be homeowners don’t have any money saved for a down payment.

Here are some key findings from that report:

- According to the most recent Census data, the Millennial homeownership rate stands at 48.6 percent, more than 20 percentage points lower than the rate for Gen X and almost 30 percentage points lower than Baby Boomers.

- Millennial homeownership lags even after adjusting for age. Among older Millennials who have hit age 40, 60 percent own homes. At that same point in life, 64 percent of Gen Xers, 68 percent of Baby Boomers and 73 percent of Silents owned homes.

- With each passing year – and accelerated by the pandemic – an increasing share of Millennial renters say they will never own a home. 22 percent of Millennial renters view themselves as “always renters” in 2021, and preliminary data from 2022 shows that share increasing.

- As Millennials age, affordability becomes increasingly important to their housing choices. Other factors in the “rent or buy” decision (e.g., lifestyle flexibility) have become less important to Millennials as they age.

- Down payment savings rates remain shockingly low for Millennials who want to buy homes. In 2021, nearly two-thirds say they have no savings whatsoever, and only 16 percent have saved more than $10,000. The average savings of just over $12,000 represents just a 4 percent down payment on a median-priced condo today.

This is discouraging. Homeownership is good for society as well as the individual. For most people, if they never own a home they will never accumulate wealth. Crime rates, fertility rates, out-of-wedlock birth rates, and other measures of a society's well-being are reflective of homeownership rates. It stands to reason that homeownership leads to generational improvements. The next generation will have a better standard of living than the previous. Never owning a home will most likely lead to the next generation being less well off than the previous. While I can state no study to support this, I suspect that homeowners feel more invested in their communities than renters. I suspect they are more grounded. I suspect they have less resentment toward society and are less inclined to support wealth redistribution schemes. I don't know this, but I suspect homeowners will generally be more conservative, or at least less radical than if they had remained renters.

Several things need to happen to reverse this trend toward lower homeownership. Governments at all levels need to stop doing the things that cause housing to become less and less affordable. We need to tinker with the tax code to encourage savings and homeownership. We need to stop focusing on "equity" and programs that make people think they are victims and focus on programs that provide opportunities for economic advancement.

You can find the full report from Apartment List at this link.

Antiquated Zoning Laws Are Worsening the Housing Crisis

The dream of homeownership is becoming more elusive by the day

Top Stories

No comments:

Post a Comment